This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

Most rewards credit cards and airline rewards programs offer options to use points to pay for travel expenses such as hotels and car rentals. Many rental car agencies offer their own rewards programs as well.

To make the most of your credit card for rewards options, it is important to understand which points can be redeemed at the most value based on your specific situation. It is also important to consider the cost of insurance coverage.

It should be noted it’s often more difficult to redeem rewards points for car rentals than for other travel expenditures such as hotel rooms or flights. The major reason for this is that payment for most rental car bookings occur upon return of the car and are not pre-paid. In fact, this is the reason that American Express does not allow members to use rewards points for car rentals.

Rewards Credit Cards Offering Primary Insurance Coverage

Unlike airlines and hotels, rental car companies do not offer co-branded credit cards. Some rewards credit cards do allow account holders to redeem their points for rental cars at specified rates, however, these rates are often not competitive enough to justify using points over cash. If you want to truly maximize the value of using rewards points for car rentals, you should make sure you are using a rewards card that offers primary insurance coverage as well. Insurance can rapidly become a major cost and using a rewards program that already factors this in will result in more savings.

Chase Sapphire Reserve and Chase Sapphire Preferred

Chase Sapphire Preferred cardholders earn 1.25 cents per point towards travel rewards. Chase offers some of the more competitive rental car rates, but I prefer to use my Ultimate Rewards for flights or hotels.

You can read this post to see more information on redeeming Ultimate Rewards points for car rentals.

Fixed-Value Rewards

In some circumstances, it just makes sense to pay cash for your rental car to take advantage of a particular rate that may not be offered by your rewards card. Fixed-value (cash back) rewards allow you the flexibility of cash with the advantage of earning money back on everyday expenditures.

Citi Double Cash Card

The information for the Citi® Double Cash Card has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

Cash rewards are available with the Citi® Double Cash Card, and there is no annual fee. Cardholders earn up to 2% back on every purchase, every day. Earn 1% back when you make a purchase and another 1% back when you pay your balance. To earn cash back, pay at least the minimum due on time.

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card earns double miles for every purchase and miles are worth 1 cent each.

However, if you are wanting to earn a few more miles on travel, good news—earn 5x miles on hotels and rental cars booked through Capital One Travel.

Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel, with the Capital One Venture Rewards Credit Card.

Airline Rewards Programs

Certain airline rewards programs also allow points to be used for qualifying travel expenditures, including car rentals. This arrangement is fairly rare, and often the rates offered are not competitive.

Southwest Airlines

Southwest does not offer an option to redeem points for rental cars directly; however, they do offer vouchers which can be used at major car rental companies such as National, Alamo, Budget, Hertz, and Avis for just 1 cent per point. Unfortunately, these vouchers come with restrictions and may be subject to expiration.

United Airlines

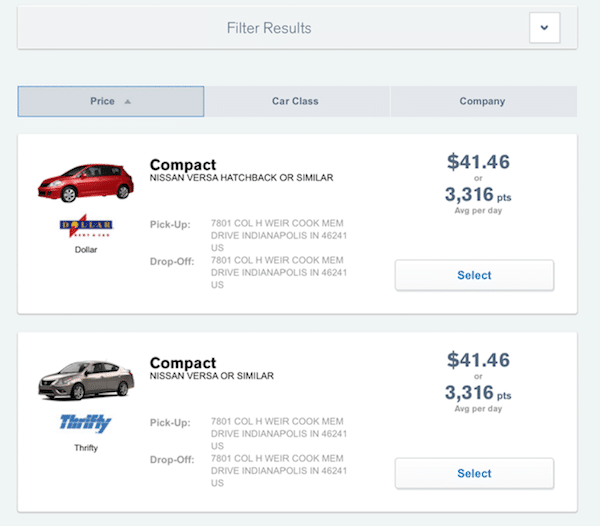

United’s MileagePlus program allows members to redeem points for rental cars directly; however, their rates are not competitive compared to other rewards program options.

Rental Car Loyalty Programs

If you prefer a particular rental company, it may be to your advantage to simply join their rewards program and accrue points that way. In some cases, you could conceivably combine loyalty points with rewards points from another source and get a better rate. This option may be more viable for those traveling for business. International travelers will find the Hertz Gold Plus program particularly rewarding.

National Emerald Club

National Rental Car offers the National Emerald Club, which allows members to earn credits towards free rentals. Emerald Club members earn one point per qualifying rental or for every four consecutive rental days. To earn a free rental, regular members need only earn 7 credits, executive members 6 credits, and elite members 5 credits.

Hertz Gold Plus

The Hertz Gold Plus program is one of the more rewarding rental car programs available. Members earn 1 point per every dollar spent on qualifying rental and service charges, fuel, and other expenditures. This rewards club really pays off for longer rentals. Redemptions for basic (non-luxury) cars start at just 550 points. Another unique feature is that Hertz rental points can be redeemed internationally.

Avis Preferred

Avis Preferred members earn one point for every $1 spent on rentals and two points for accessories. Once a preferred member has reached 12 rentals or spent $5,000, they are upgraded to Plus status and earn points at higher multipliers.

Budget Business Program

This program is primarily aimed at businesses, but individuals may sign up as well. Members earn $3 for every qualifying rental day and rewards are distributed quarterly in the form of certificates in $15 increments. Members can use up to seven certificates ($105) at a time.

Enterprise Plus

The Enterprise Plus program offers members one point for every $1 spent. Free rentals start at 450 points and, best of all, there are no blackout dates. The program offers three status levels (Silver, Gold, or Platinum), and each offers its own benefits and access to more rewards options.