This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

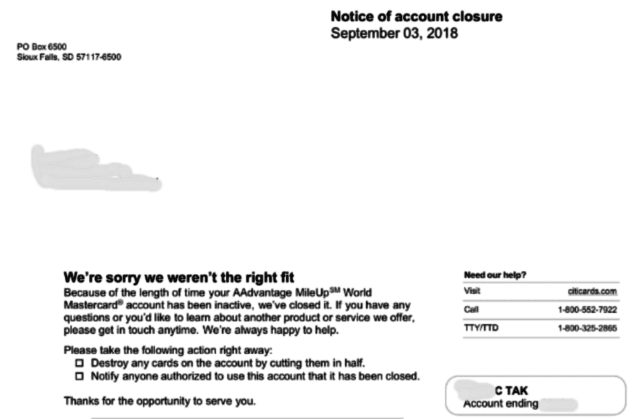

I received a letter last month from Citi/AAdvantage Bronze Mastercard informing me that they were breaking up with me. In other words, they closed my account. The notice even said, “Sorry we weren’t the right fit.”

Well, they did have a point. I hadn’t touched that credit card in the last five years, despite being a cardholder for about eight years. I used to fly American Airlines frequently for work, but once I switched jobs, that card went straight into a drawer.

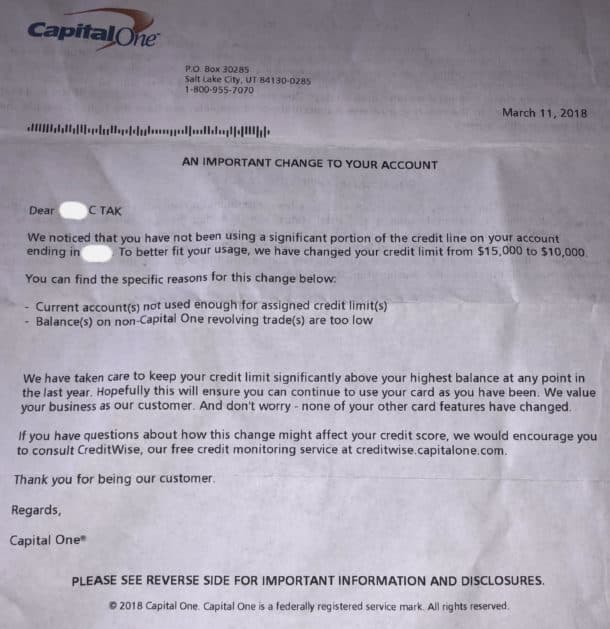

This account closure happened following a separate credit card notice I received from Capital One a few months prior, alerting me that my credit limit was lowered from $15,000 to $10,000. As a result, my overall credit utilization changed because of the lowered limits.

I started to think: Should I be concerned?

How my credit utilization was affected

The lowered limit meant that my overall credit utilization was $15,000 lower than it once was.

Credit utilization is the percentage of your available credit you’re using. For example, if you had $5,000 in available credit and balances of $1,500, your utilization would be 30% (1,500 divided by 5,000 is .30). Finance experts recommend staying below the 30% utilization limit, but keeping it lower than 10% is ideal.

Now, let’s say the issuers decided to cancel one credit card with a $2,000 limit. The credit utilization just jumped to 50%!

Luckily for me, I don’t carry that much debt, so the account closure and $5,000 lower limit didn’t negatively affect my credit. However, this may not be the case for you if you carry debt.

How and why did this happen?

One of the reasons credit card issuers cancel accounts is due to inactivity. I hadn’t touched both cards in years, so this really didn’t come as a big surprise, but at the same time, it kind of did. My knee-jerk reaction was: I have excellent credit, I pay my bills on time, I’m the poster child for using credit cards responsibly! Then it occurred to me that I’m only a shining example of a credit card user to myself.

Both Capital One and Citi wanted me to use the cards — they practically begged me to use them with offers galore for low cash advances and balance transfer offers.

Credit card companies make money from transaction fees paid by merchants and interest (if you carry a balance). They weren’t making any money from me, so they canceled my account.

The fine print tells you they can close your account

A credit card issuer can close your account at any time, for any reason. It says it in the fine print (that no one ever bothers to read).

They’re also not required to give you any notice if they are canceling your card due to inactivity. This isn’t to be confused with the Credit Card Act of 2009 that requires creditors to give you at least 45 days’ notice before any major changes to the terms of your account.

3 tips to prevent credit card closures from your creditor

If you’re like me and have some credit cards sitting in your drawer, here’s what you can do to prevent account closures.

1. Link them to monthly subscriptions

I tied a few of my dormant credit cards to monthly streaming subscriptions — one to my Spotify and another to my Audible account.

This ensures that they are active without putting a high amount on them. I can easily pay these off each month. This is an easy way to stay active and help prevent credit card closures.

2. Add them to your Apple Wallet or Android Pay

I dislike carrying credit cards around, so I made better use of Apple Pay.

I added all of my cards to it so I have easy access to them. Plus, I’m more inclined to use it for small purchases when I’m at a store that accepts Apple Pay. Note: Not all credit cards are compatible with Apple Pay or Android Pay. Chase Ink, I’m looking at you!

Pro tip: Tie in your purchases with rotating bonus categories for your credit cards.

3. Link your cards to Mint

Part of the reason why I was hesitant to use my cards in the past was because I didn’t want to forget that there was a balance on the card.

I use a free website called Mint and connected all of my accounts in there. This lets me see each balance and remember to pay them.

In case you are not familiar with Mint, it’s a tool that allows you to link all of your bank accounts, credit cards, and loans in one place.

Bonus tip to prevent credit card closures: What you can try if your card was closed or limit decreased

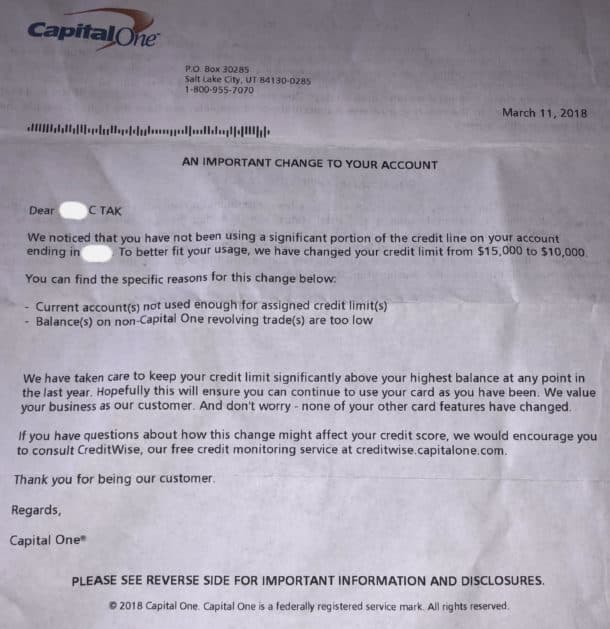

I contacted Capital One and asked if they would reconsider my credit limit decrease and bring me back up to $15,000. They informed me I had to request a credit line increase.

About two weeks later, I received this letter in the mail stating that I wasn’t currently eligible.

I’m going to wait until the end of the year to request another increase. By then, I’ll have regularly used the card.

Bottom line to prevent credit card closures

If you want to prevent credit card closures and don’t want your credit score to potentially drop, use your credit cards regularly with the simple tips I mentioned.

Credit card companies want you to use your credit cards. In turn, you can continue to maintain your good credit score. Even if you don’t need a great credit score now, you’ll need it in the future if/when you decide to make a big purchase, such as a house or car.

Just remember to pay your balances in full and on time each month.