This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

A couple of years ago I was travelin’ fool. I quit my full-time job and decided to consult just so I could travel. I was on a plane every single month, whether it was a two-hour flight to Seattle or a 22-hour flight to Sydney. Plus, I already knew the Chase Sapphire Reserve® bonus was appealing, but it was time for me to research the Chase Sapphire Reserve benefits and perks.

To prepare myself for such frequent travel, I signed up for the Chase Sapphire Reserve when it first came out. The Sapphire Reserve has a pretty sweet deal for 60,000 bonus Chase Ultimate Rewards® points, but it was higher on its initial release.

New Chase Sapphire Reserve® cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when redeemed through Chase Ultimate Rewards®.

Earning the Bonus for Chase Sapphire Reserve

In order to receive the bonus, I had to spend $4,000 within the first three months, which I had zero problems doing. The bonus broke down to about $1,500 in travel, so the $550 annual fee didn’t prevent me from getting the card.

I opened the travel card in March 2017, and since then, I’ve used it for almost every single purchase. I probably racked up close to 150,000 points in the last few years, in addition to the 100,000 bonus points I received in the signup bonus that was available at the time.

Tip: The two biggest ways I’ve managed to rack up points are by booking flights through the Chase.com portal and using the card at restaurants.

Contents

Use this table to jump to specific sections in this guide:

5 reasons to love Chase Sapphire Reserve Perks

- No Blackout Dates for Travel

- $300 in Travel Credit Each Year

- Earn Points on Travel and Dining

- Access to Priority Pass Lounges at Airports

- Get Reimbursed $100 for Global Entry

- Awesome Concierge and Customer Service

More Information About Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Benefits Recap

- Bonus Rewards

- Chase Sapphire Reserve Purchase Rewards

- Annual $300 Travel Credit

- Complimentary Airport Lounge Access

- Global Entry Credit

- Hotel Perks

- VIP Event Access

- Rental Car Benefits

- Trip Protection Insurance

- Purchase Protection

- Summary

Chase Sapphire Reserve Benefits & Perks

Even though my travel has slowed down significantly, I still use the card daily and continue to rack up points. Here are the top five reasons I love my Chase Sapphire Reserve and why I use it for just about everything.

1. There are no blackout dates for travel

When I used to travel coast-to-coast frequently, I used the American Airlines Citi® / AAdvantage® Platinum Select® World Elite Mastercard®. I loathed the restrictions and blackout dates. Planning a simple trip from L.A. to NYC became a juggling act of aligning the dates and times with meetings. Not fun.

I appreciate that I never have to experience this with Chase Sapphire Reserve. As long as there’s a seat on the flight, I can book it.

One thing to note is that when you book through the Chase portal for flights, you won’t always get a seat assignment. At first, this seemed pretty scary, but I never had a problem getting a seat. A lot of times, I had to go to the ticket counter to get my seat assignment and paper ticket.

2. I get $300 in travel credits each year

In addition to the sign-up bonus I received, Chase offers a $300 travel credit each year as reimbursement for travel purchases charged to your card each account anniversary year. The credit applies to purchases related to hotels, motels, timeshares, discount travel sites, toll bridges, parking, and more.

I don’t need to register to receive the credit and it resets each calendar year in January. This is definitely a reward in regard to Chase Sapphire Reserve®’s perks.

3. I earn points on travel and dining and more

Chase Sapphire Reserve® purchases earn up to 10x Chase Ultimate Rewards®. Cardholders can earn unlimited:

- 10x total points on hotels and car rentals purchases through Chase Ultimate Rewards (after the first $300 is spent on travel purchases annually)

- 10x total points on Chase Dining purchases with Ultimate Rewards

- 5x total points on flights when you purchase travel through Chase Ultimate Rewards (after the first $300 is spent on travel purchases annually)

- 3x points on other travel worldwide (after the first $300 is spent on travel purchases annually)

- 3x points on other dining at restaurants, including eligible delivery services, takeout, and dining out

- 1x points for all remaining purchases

You will not receive rewards points on your first $300 in annual travel purchases as the annual travel statement credit reimburses these purchases.

Since traveling and dining out kind of go hand in hand, earning points was easy for me since my spending was heavy in both categories.

It also helped a lot when I traveled internationally and was still able to earn points while abroad (some credit card companies won’t allow you to earn points if you’re overseas). I also never paid a cent in foreign transaction fees since the Chase Sapphire Reserve doesn’t charge any.

Tip: I also have a Chase Ink and Chase Freedom, so I combine the points to the Chase Sapphire Reserve card once a quarter (even though you can combine points at any time).

4. I have access to Priority Pass Lounges at airports

Sometimes, you don’t know what you’re missing until you experience it. In all my years of travel, I never really had access to airport lounges unless I was with friends who had access.

One of the Chase Sapphire Reserve perks is that I have access to lounges at over 1,200 airports worldwide. There were moments when the airport crowds were so completely draining that seeing a lounge nearby was a godsend.

I got into the habit of arriving at airports early just so I could sit in the lounge and get some work done before my flight. I’d pile my plate with plenty of fruit and snacks. Let’s not forget the occasional wine or cocktail!

Note: If you’re thinking about getting the Chase Sapphire Reserve and want to take advantage of Priority Pass Select, you need to sign up for it separately. Use their app and update it regularly so you can quickly locate Priority Pass lounges at airports around the world.

4. I got reimbursed $100 for Global Entry

One of the biggest Chase Sapphire Reserve perks for people that travel internationally is that Chase reimburses you the $100 application fee for a Global Entry card. The card gives you expedited clearance when traveling back to the U.S. from a foreign country. In a nutshell, you can skip long lines at passport control and customs.

I signed up for my appointment at the Global Entry Enrollment Center, which was at the San Francisco International Airport. I applied in April but wasn’t able to secure an interview until November.

Despite the long wait, I happily showed up. After being asked a few questions by a sheepish border patrol agent, I received my card in the mail about a week later.

I traveled internationally after receiving the card, so it definitely came in handy. There’s nothing quite like skipping a massive line when you’ve been traveling for 20 hours!

5. Concierge and customer service are really awesome

Anytime I need to call Chase, I never wait long to speak to someone. Plus, they’re open 24/7.

I had to call customer service when I left my card at a restaurant in Lake Tahoe and didn’t realize it until I got home. Within two days, I had a new card FedExed to me for free.

Chase Sapphire Reserve also comes with a concierge service provided by Visa Infinite Concierge Service. A lot of people don’t even realize this exists, which is such a shame!

The concierge helped me out when I was traveling in Las Vegas and needed tickets to a sold-out show. I called, and by some miracle, they were able to get me tickets!

So, while I don’t have any major travel plans in the near future, I’m quietly racking away points for my big snowboarding trip to Japan next year. Chase Sapphire Reserve perks are the reason why this will remain my go-to card. The alluring benefits and easy ways to rack up points make this card great.

Recap Chase Sapphire Reserve Benefits – All You Need to Know

One of the primary reasons you travel with a premium travel card is for the benefits. The Chase Sapphire Reserve® benefits are some of the best in the travel rewards industry. While you can also earn points on travel purchases and get a better award travel redemption rate than most travel rewards cards, rewards points are not the only reason you might carry the Chase Sapphire Reserve in your pocket.

Chase Sapphire Reserve Purchase Rewards

While the Chase Sapphire Reserve® benefits are definitely the yang, the purchase rewards are the yin to making the Sapphire Reserve is an awesome travel rewards card.

As a reminder, cardholders can earn unlimited:

- 10x total points on hotels and car rentals purchases through Chase Ultimate Rewards (after the first $300 is spent on travel purchases annually)

- 10x total points on Chase Dining purchases with Ultimate Rewards

- 5x total points on flights when you purchase travel through Chase Ultimate Rewards (after the first $300 is spent on travel purchases annually)

- 3x points on other travel worldwide (after the first $300 is spent on travel purchases annually)

- 3x points on other dining at restaurants, including eligible delivery services, takeout, and dining out

- 1x points for all remaining purchases

You will not receive rewards points on your first $300 in annual travel purchases as the annual travel statement credit reimburses these purchases.

Welcome Bonus

New Chase Sapphire Reserve® cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when redeemed through Chase Ultimate Rewards®.

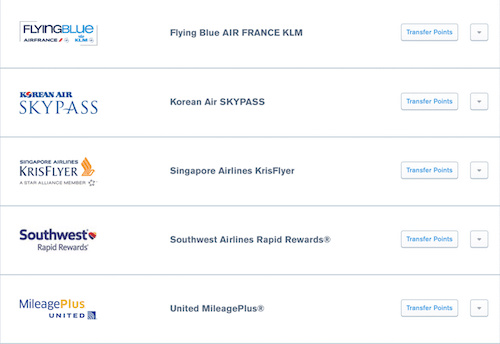

This is because each point is worth 1.5 cents each on award travel booked on the Chase Ultimate Rewards Mall. Or, you can transfer your points on a 1:1 basis to several airline and hotel travel partners.

With a value of 1.5 cents apiece, you will have a hard time finding a more valuable reward point. Every 10,000 points redeemed is worth $150 in award travel whether it is plane tickets, hotel nights, cruise reservations, or paid excursions. Other flexible travel rewards cards might offer the highest redemption value for plane tickets or a flat redemption value of one penny ($0.01) per point.

Annual $300 Travel Credit

If you could only use one word to describe the Chase Sapphire Reserve®, it would have to be flexible. Each year, you receive a $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year. Unlike other premium cards, Chase will apply the travel credit to the cost of airfare, hotel nights, or any other travel expense that can earn points in purchase rewards.

Complimentary Airport Lounge Access

You also gain complimentary access to the Priority Pass Select airport lounge network that has over 1,000 worldwide locations. With each Priority Pass lounge visit, you can enjoy free Wi-Fi, snacks, and beverages that will make you never want to pass a layover in the terminal again.

Global Entry Credit

Another nice Chase Sapphire Reserve® benefit is the application fee credit when you apply for Global Entry or TSA Precheck. That is a savings of $100 every five years. And, you get to skip the long security lines and body scanners in the process.

Hotel Perks

You won’t receive upgraded membership status to any particular hotel brand, but, you are eligible for complimentary room upgrades, meals for you and a guest, early check-in or late check-out, and additional amenities, discounts, and credits from the Luxury Hotel & Resort Collection.

Or, you can also enjoy fast-track access to Club 5C status with Relais & Chateaux after spending two nights within the first 12 months by paying with your Sapphire Reserve.

VIP Event Access

One benefit of owning a premium travel credit card is that you get exclusive access to VIP events. Sapphire Reserve members can also get early access to events sponsored by Chase like “eat and greet” dinners with musicians and chefs or on-field experiences at professional sporting events. Sometimes, the best card benefits are the ability to enjoy experiences that very few others can.

Chase Sapphire Reserve Rental Car Benefits

You can enjoy three separate benefits when you pay for a rental car with the Chase Sapphire Reserve®. For starters, you will enjoy elevated benefits with National, Car Rental, Avis, and Silvercar such as free upgrades and car rental discounts.

Save some additional money by declining the collision damage waiver policy offered by the rental car agency. The Sapphire Reserve is one of the very few credit cards that offer primary collision and theft damage coverage. As the coverage is primary, Chase will reimburse the first $75,000 in damage done to the rental vehicle or any other involved vehicles involved. The coverage is good for most makes and models within the U.S. and many foreign countries.

A third benefit is complimentary roadside assistance. Up to four times a year, Chase will cover the first $50 in expenses when you need a tow, jumpstart, or help to change a flat tire. This is one of the few Chase Sapphire Reserve benefits that are available for rental and personal cars.

Trip Protection Insurance

While this is one card benefit nobody wishes to use, it is nice to have. If your travel plans get interrupted or canceled, Chase will reimburse you up to $10,000 in prepaid non-reimbursable travel expenses. It can be used for tours, hotels, or passenger fares.

Chase will also reimburse you up to $500 per ticket for essential expenses like food and lodging when your common carrier travel is delayed at least six hours or requires an overnight stay. And, if your baggage gets delayed, lost, or damaged by the carrier, you will also be reimbursed up to $3,000 per passenger.

Suppose you have a medical emergency once you begin your trip. In that case, Chase will cover up to $2,500 for medical and dental expenses if you or an immediate family member need medical attention. And, they will reimburse up to $100,000 for an emergency evacuation if necessary.

The trip protection coverage does not have a “cancel for any reason” policy.

Purchase Protection

For non-travel purchases, Chase offers up to $10,000 per claim when an item is damaged or stolen within the first 120 days. You can also be reimbursed up to $500 per item if the price drops within 90 days or the same amount for items ineligible for store returns.

Finally, Chase will automatically extend the warranty on select purchases an additional year on original manufacturer warranties of three years or less.

Summary of Chase Sapphire Reserve Benefits

In conclusion, many travelers might initially look at the Chase Sapphire Reserve® for the robust sign-up bonus, purchase reward tiers, and flexible options to redeem points. The reason they might choose the Sapphire Reserve instead of the Chase Sapphire Preferred is for the benefits. It’s not every day you get a credit card that pays you back to travel, gives you complimentary membership to airport lounges, and other great travel perks.

Related Posts:

I love this post!Thanks for sharing these tips and it is very helpful for beginners.Thank you for sharing.

Excellent post for someone who is shopping for credit cards. Thanks for the details. Made my choice easy.