This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

Chase Ultimate Rewards is a valuable point currency, which can be leveraged for a wide variety of travel opportunities. There are two ways to use Ultimate Rewards for travel: transferring points to airline and hotel programs, or redeeming points directly for airfare, hotels, or rental cars at a fixed rate. This is a good reason for a Chase Ultimate Rewards guide post.

There are a lot of travel credit cards that offer Chase Ultimate Rewards points, but not all points are created equal. You’ll need a card with an annual fee, like the: Chase Sapphire Preferred® Card, Chase Sapphire Reserve, Chase Ink Plus, or Ink Business Preferred® Credit Card to transfer points to an airline or hotel partner. All Chase cards with Ultimate Rewards allow you to redeem points for travel, but the value of the points varies depending on the card:

- No Annual Fee Cards (Chase Freedom, Chase Freedom Unlimited, Chase Sapphire, Chase Ink Cash): 1 point = 1 cent

- $95 Annual Fee Cards (Chase Sapphire Preferred, Chase Ink Plus, Chase Ink Preferred): 1 point = 1.25 cents

- $550 Annual Fee Card (Chase Sapphire Reserve): 1 point = 1.5 cents

Cards That Earn Chase Ultimate Rewards so You Can Transfer To Travel Partners:

- Chase Sapphire Preferred® Card – Perks and $95 annual fee

- Chase Sapphire Reserve® – Premium Travel Credit Card

- Ink Business Preferred® Credit Card – 100,000 Point Bonus

Getting Started with Chase Ultimate Rewards Guide

Start by logging in to the Chase Ultimate Rewards website at ultimaterewards.com

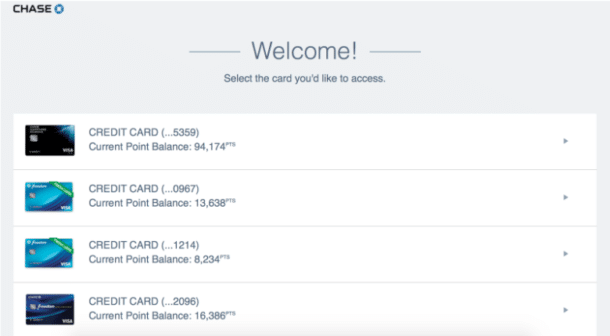

If you have multiple Chase Ultimate Rewards cards, you’ll need to select the credit card account you want to use. Because the point values vary, you’ll usually want to choose your most expensive card on this screen. (Don’t worry – you can switch cards, or transfer points between cards later.)

This will take you to your specific card’s Ultimate Rewards home page.

Transferring Ultimate Rewards Points to Airline and Hotel Partners

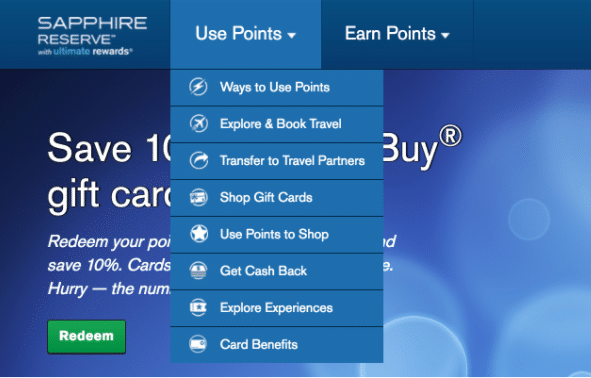

Hover over “Use Points” at the top of the screen and select Transfer to Travel Partners.

This will bring you to a list of airlines and hotel programs. You can transfer Ultimate Rewards points to nine airline partners: Air France/KLM, Aer Lingus, British Airways, Iberia, Korean Air, Singapore Airlines, Southwest, United, and Virgin Atlantic. You can also transfer points to four hotel programs: IHG, Marriott, Ritz-Carlton, and World of Hyatt.

Next to each program, you’ll see a “Transfer Points” button. Click that button.

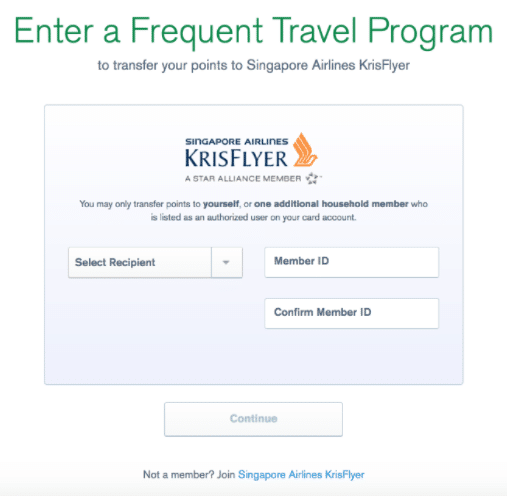

This will bring you to a screen where you can enter your frequent flier details.

You can transfer points to an account in your name or in the name of one other member of your household who is an authorized user of your card. Be careful – if you select an authorized user and transfer points to them, they will be the only other person you can ever transfer points to in the future!

Use the drop-down menu to select the name of the account holder, then enter their account number twice. Click Continue.

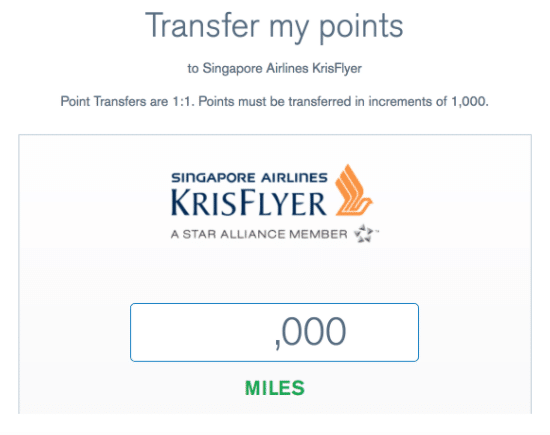

Now that Chase has your account number, you can transfer points to your account. Points must be transferred in 1,000 point increments. Type in the number of points you want to transfer and click Continue.

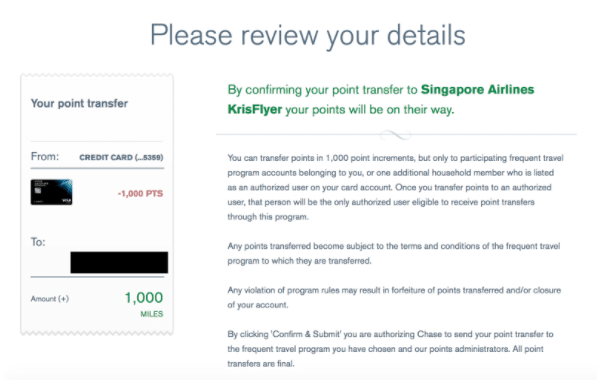

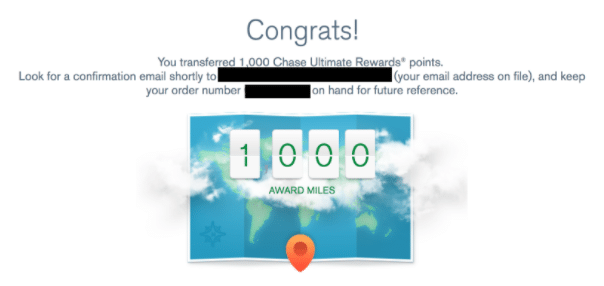

This is your final opportunity to verify your transfer details. Check to make sure that the number of points to be transferred and the destination account number are correct, then click Confirm & Submit.

Success! Your points have been transferred, and in most cases should appear immediately in your frequent flier or hotel account. (If you are logged into the airline or hotel’s website, you may need to log out and log back in before the points will appear.)

Spending Chase Ultimate Rewards Points for Travel Purchases

Redeeming Chase points directly for travel purchases can be a good deal in some cases – there are no restrictions on availability as long as tickets or hotel rooms are available for purchase, and you’ll earn miles or points on the ticket just like if you paid for it out of pocket. And if cash prices are low, you may spend fewer points than you would for the same flight or hotel room if you transferred your Ultimate Rewards points to book an award!

Hover over “Use Points” at the top of the screen and select “Explore & Book Travel.”

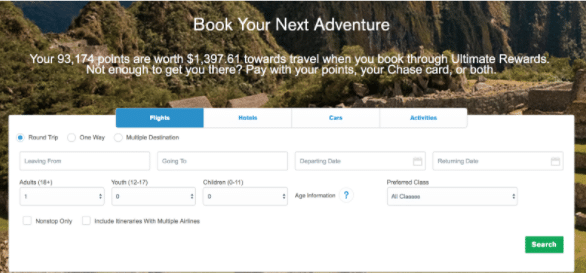

This will bring you to a screen that should look familiar if you have used a travel search engine or online travel agency like Kayak, Expedia, or Priceline. To book a flight, enter your flight details and click Search.

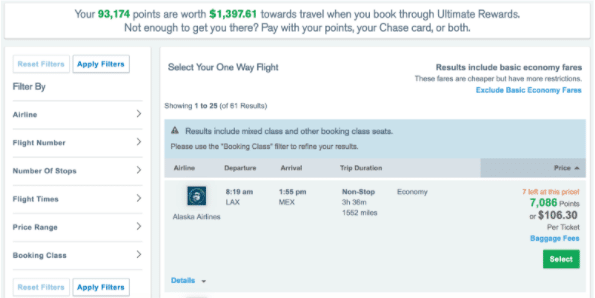

After a minute or so, you should see your search results.

(In the upper right corner, you may see a message saying that your search includes Basic Economy fares – which depending on the airline may exclude seat assignments, the ability to make changes, or carry-on baggage. If you want to exclude these fares from your search, click “Exclude Basic Economy Fares.”)

You can use the filters in the left column to refine your search. On the right side, you’ll see a selection of flights listed – by default, they are sorted by price, but you can click the section headers to sort by airline, departure or arrival time, or flight duration.

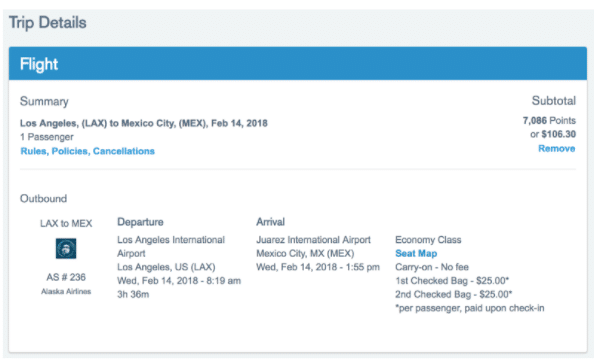

Under Price, you’ll see two numbers listed: a price in points and a price using cash. Find the flight you want and click the Select button. After a few seconds, you will be presented with the full flight details.

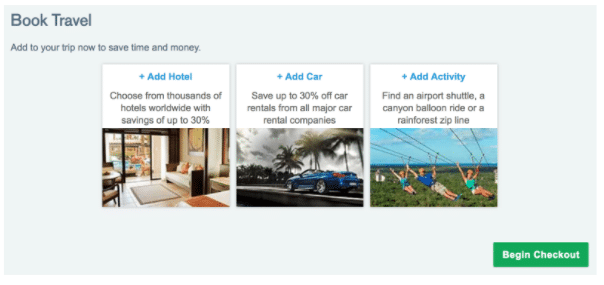

If all looks as expected, scroll to the bottom of the page. Chase will give you the option to add hotel, car rental, or activity to your reservation; to proceed with your booking, click Begin Checkout.

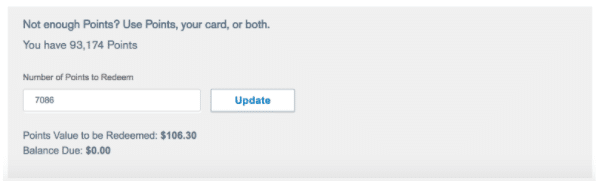

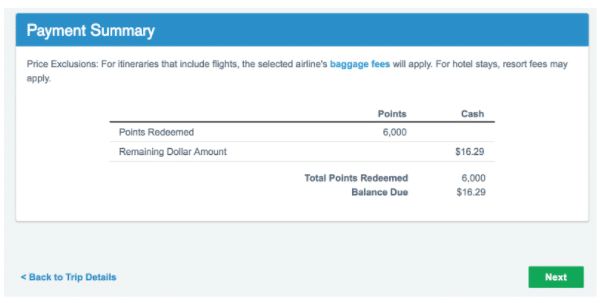

This will bring you to your Rewards Summary, where you can select how many points you want to use for your booking. If you don’t want to use points to cover the full cost, you can manually change the number of points you want to spend and click Update.

Scroll down to the bottom of the page to review the payment breakdown, then click Next.

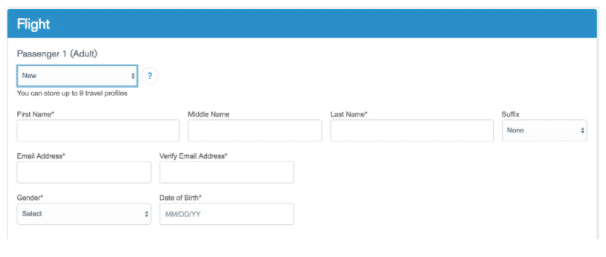

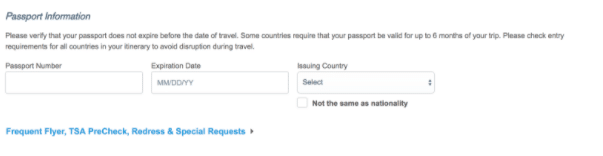

On the next screen, you will be asked to enter the passenger’s details, including passport information if you are booking an international flight. Fill in the passenger’s information.

At the bottom of the page, you’ll see blue text that reads “Frequent Flyer, TSA PreCheck, Redress & Special Requests.”

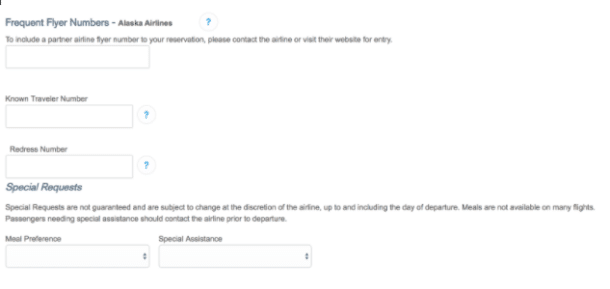

You can click this link to open additional fields for a frequent flier number, known traveler number, or redress number, as well as meal preference or accessibility requests.

Note that Chase will only accept frequent flier number(s) for the airline or airlines operating your itinerary, not for partners – so if you want to earn British Airways points for your Alaska Airlines flight, you’ll need to wait and enter your British Airways number directly on the Alaska Airlines website. In any case, even if you enter your details here, verify them carefully on the airline website after your reservation is confirmed – often these numbers and requests don’t get passed on to the airline correctly.

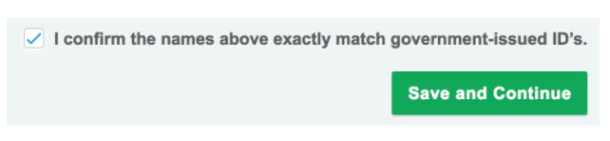

Once the passenger’s details are complete, check the box to verify that they match the passenger’s ID, and click Save and Continue.

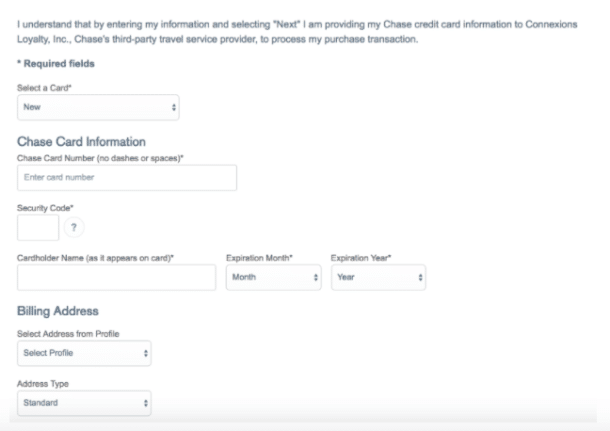

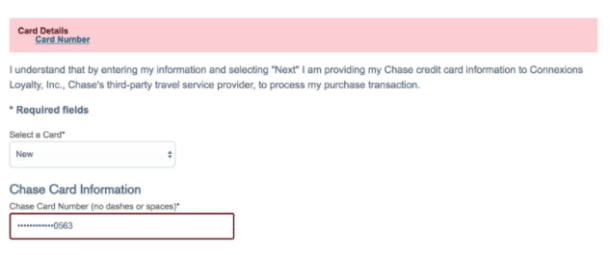

If you have elected to use a credit card to pay for part of your ticket, you’ll need to enter your credit card details here.

The system will only allow you to use a Chase credit card for payment – if you attempt to use a different credit card, it will give you an error message.

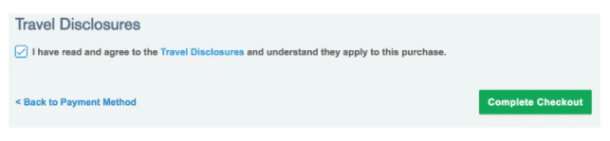

Once you click Next (or if you elected to use points for the entire cost), you’ll get a screen to review your flight, traveler, and payment details. If everything looks okay, check the box and click “Complete Checkout.”

You’ll get a confirmation screen and an email informing you that your booking was successful, including a flight confirmation number.

You should be able to use that number to access your reservation on the airline website to verify that your additional details (like frequent flier and known traveler numbers) are correct, and to select your preferred seats.

At any time, you can access your booked reservations through ultimaterewards.com by clicking Trips in the upper right corner – the number in the box indicates how many active reservations you have made.

Combining UR Points From Multiple Ultimate Rewards Cards

If you have multiple credit cards that earn Chase Ultimate Rewards (UR) points, you can combine your points balances onto a single card. This is most often used to move points from a no-annual fee card like the Chase Freedom to a premium card like the Chase Sapphire Reserve or Chase Sapphire Preferred, which then allows you to transfer the points to travel partners or redeem them at a more favorable rate.

While logged in to ultimaterewards.com, hover over your points balance in the upper right corner to see a list of your Ultimate Rewards cards. At the bottom of the list, click Combine Points.

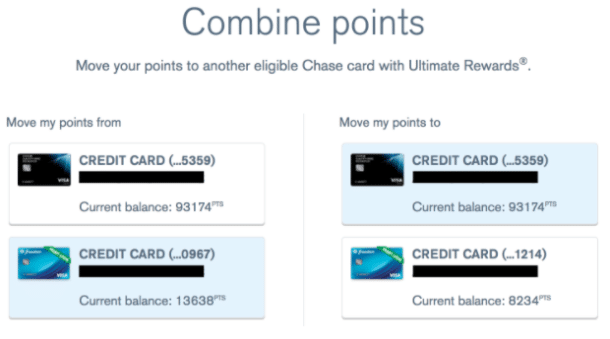

Select the cards you want to transfer points from and to. (If you have multiple Chase accounts, or you want to transfer points to a member of your household, click “Add household member” and enter the card details.

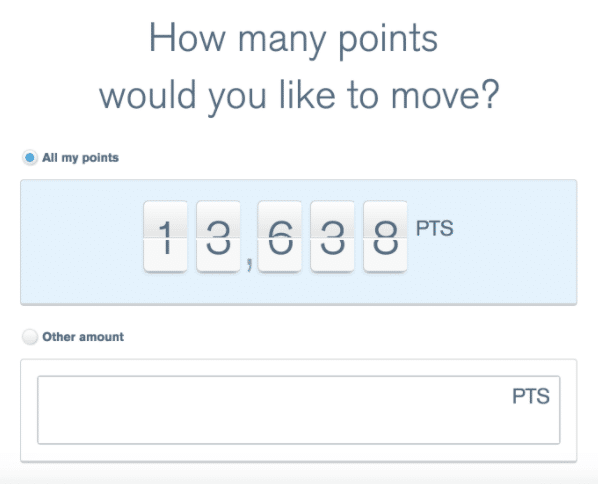

You will be prompted for how many points you want to move. It will select your entire points balance by default, or you can enter a specific number of points.

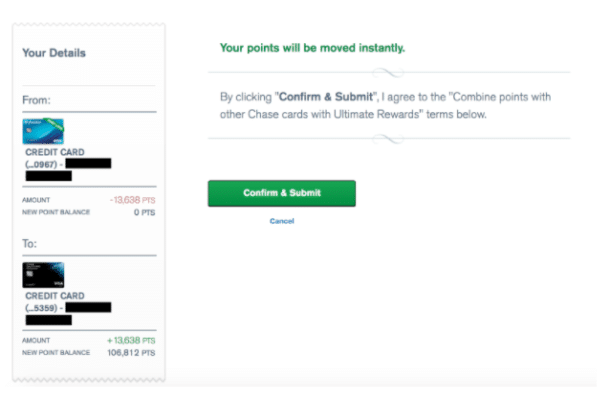

Review the transfer details. If everything looks good, click Confirm & Submit.

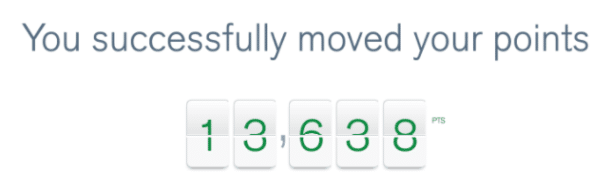

You will see a confirmation screen, and your points have instantly been transferred to the other card.

How to Get Chase Ultimate Rewards Points

The best way to earn Chase Ultimate Rewards points is to sign up for an Ultimate Rewards credit card from Chase. There are several options:

- Chase Sapphire Reserve® – New Chase Sapphire Reserve® cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when redeemed through Chase Ultimate Rewards®. ($550 annual fee)

- Chase Sapphire Preferred® Card – New Chase Sapphire Preferred® Card cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $750 when redeemed through Chase Ultimate Rewards®. Member FDIC

- Ink Business Preferred® Credit Card (Business) – New Ink Business Preferred® Credit Card cardholders can earn 100k bonus points after spending $8,000 on purchases in the first 3 months from account opening. That’s $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠. ($95 annual fee)

As mentioned earlier, the no-annual-fee Chase Freedom and Chase Freedom Unlimited cards can also earn you Ultimate Rewards points, but you’ll need one of the above cards to transfer the points to partners or get the best value when booking travel through the Ultimate Rewards website.

All of these cards are subject to Chase’s “5/24” rule, which means you are unlikely to get approved for a card if you have opened 5 or more credit cards with any bank within the past 24 months. (Most business credit cards, including Chase business cards, don’t count toward this limit).

Thank you for the excellent step by step directions.

No longer accurate. Some of these airlines have terminated their relations with UR points.

Thanks, we’ll update the post accordingly.